Dreaming of owning a home in sunny San Diego but facing challenges with traditional mortgage requirements? San Diego's non-conforming loan products might be the perfect solution for you. These specialized loans offer more accommodating underwriting guidelines, making it easier to qualify even with unique financial situations.

- Non-QM loans in San Diego consider various factors beyond traditional metrics when assessing your lending capacity

- Independent contractors can often find attractive loan options with Non-QM loans in San Diego

- These loans provide a wider range of mortgage products to suit your specific real estate needs

Talk to with a reputable lender specializing in Non-QM loans in San Diego to explore your options and discover how these innovative financing solutions can help you achieve your homeownership dreams.

California Non-QM Loan Solutions: Discover Your Choices

Are you a applicant in the West Coast looking for alternative mortgage solutions?? If you answered yes, then California Non-QM lending may be just what you need. Non-QM loans offer a broader range of criteria than traditional financing, making them a useful tool for buyers who may not be non qm loans california eligible for typical mortgages.

- Consider Non-QM loans if you have self-employed income

- Investigate the advantages of Non-QM lending, such as higher loan amounts

- Consult a knowledgeable mortgage professional to explore your possibilities and determine the best Non-QM loan product for your individual needs.

Don't let financing obstacles hold you back from owning your dream asset. Explore the world of California Non-QM lending and discover the solutions that await.

Obtaining Non-QM Loans Near Me: A Guide for San Diego Homebuyers

Are you a ambitious San Diego homebuyer searching for financing options beyond standard mortgages? Non-QM loans can be a powerful tool to achieve your homeownership dreams. These alternative loan products are designed for borrowers who may not qualify the strict criteria of mainstream lenders.

- In San Diego's dynamic real estate scene, Non-QM loans can provide you with the opportunity to obtain your desired property, even if your financial profile doesn't match to traditional lending norms.

- Grasping the nuances of Non-QM loans is crucial for navigating this specialized financing arena.

Investigating reputable lenders who specialize in Non-QM loans is the initial step. Consult with a experienced loan officer who can advise you through the process and design a loan solution that meets your individual needs.

Unveiling the Secrets of Non-QM Loans: Your Path to Homeownership

Stepping into the realm of homeownership can feel like navigating a complex labyrinth, especially when traditional mortgage options fall short. But don't despair! Specialty financing offer a unique pathway for borrowers who may not meet the criteria conventional lending standards. These loans provide tailored solutions, allowing you to access your dream home, even with unconventional income streams, credit histories, or asset types.

- Let's the fundamentals of Non-QM loans and explore how they can be your key to financial freedom

- Discover the various types of Non-QM loans available, catering to diverse needs

- Understand insights into the qualification process and identify which Non-QM loan might be the perfect fit for your unique circumstances

With a clear understanding of Non-QM loans, you can confidently navigate the homebuying journey and turn your aspirations into reality.

Navigating California's Real Estate Landscape with Non-QM Loans

In the dynamic Golden State real estate market, finding the right financing solution can be a crucial step. Traditional mortgage lenders often have strict requirements, which can disqualify borrowers who don't fit their criteria. This is where Non-QM loans stand out as attractive alternatives, offering options to a wider range of borrowers.

- {Non-QM Loans are a type of mortgage that does not conform to standard guidelines set by Fannie Mae and Freddie Mac.

- They can be appropriate for borrowers with unique financial situations, such as self-employed individuals or those with recent credit issues.

- {Lenders offer various types of Non-QM loans, including stated income loans, copyright loans, and DSCR loans.

- It's important to thoroughly evaluate different Non-QM loan options and contrast interest rates, terms, and fees before making a choice.

With the help of an experienced mortgage broker, borrowers can explore the Non-QM loan landscape and find the best match for their circumstances.

Could Non-QM Loans Suit Right For You? Understanding the Benefits and Risks

Non-QM loans, or non-qualified mortgages, are a form of mortgage that doesn't always adhere to conventional lending guidelines. This can make them a viable option for homebuyers who may not be eligible for a standard mortgage. However, it's crucial to completely understand both the upsides and the risks before selecting if a Non-QM loan is right for you.

Some of the likely benefits of Non-QM loans include access to financing for borrowers with unique income sources, lenient credit standards, and alternatives for multifamily homes.

On the other hand, Non-QM loans often come with more expensive terms compared to standard mortgages. They may also have greater initial investments and limited financing terms. It's important to completely evaluate all options and discuss a lending expert before making a choice about whether a Non-QM loan is the right fit for your personal circumstances.

Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Heath Ledger Then & Now!

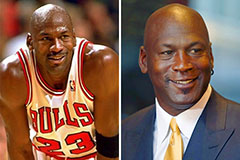

Heath Ledger Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!